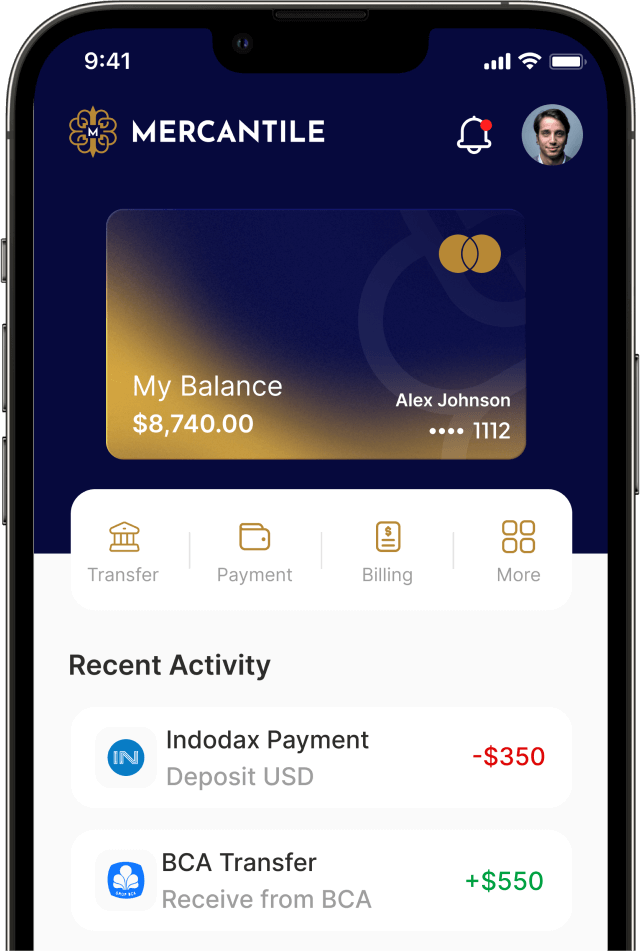

Bespoke Enterprise Products

Explore Mercantile’s personalized approach to meeting your unique financial needs.

Easy global transfers at great rates

Send and receive money in 135 currencies with no hidden fees. Plus, transfers are always instant between friends, no matter where they are.

Innovative Financial Solutions

Mercantile provides financial solutions designed to empower your vision.

A better way to handle money

One app for all things money. From your everyday spending, to planning for your future with savings and investments.

Building a Global Community

From Web3 and the Blockchain to Clean Energy Technology, robotics and Artificial Intelligence, technology is advancing at an ever-increasing pace and revolutionizing the way we interact and communicate with one another. We are now able to connect with people from all corners of the world and share our ideas and experiences instantaneously, creating a global community.

With our technical and financial expertise, Mercantile Bank International is at the center of these technological advancements. By partnering with start-ups and established businesses in tech, energy transition, digital assets and creative entrepreneurship we help turn visions into reality. Mercantile Bank International will be at the forefront of building an even more connected and collaborative global community, working together to solve the world’s most pressing challenges.

The future of banking is already here.

Apply for your MBI Bank Account today!

Industry News

-

BlackRock files for a Bitcoin spot ETF

The world’s largest asset manager BlackRock has recently filed for a Bitcoin spot ETF as regulatory scrutiny on the Crypto industry intensifies.

-

Biden cancels Australia visit as debt ceiling default nears

Pilot programs designed to promote diversity in banking, expose students to a wide array of careers within the banking industry.

-

Crypto should be regulated as gambling, UK lawmakers say

Pilot programs designed to promote diversity in banking, expose students to a wide array of careers within the banking industry.